Investing is a cornerstone of financial planning, and few debates spark as much interest as the one between real estate and the stock market. Both avenues have created millionaires, yet they appeal to different investor profiles based on goals, risk tolerance, and time horizons. In this comprehensive article, we’ll dissect the key aspects of each investment type, drawing on historical data, expert insights, and real-world examples to help you determine which might suit your strategy better. Whether you’re a novice building your first portfolio or a seasoned investor reassessing allocations, understanding these options is crucial in today’s dynamic economic landscape.

Understanding Real Estate Investing

Real estate investing involves purchasing physical properties, such as residential homes, commercial buildings, or land, with the aim of generating income through rentals or capital appreciation over time. This form of investment has been a staple for wealth building for centuries, offering tangible assets that investors can see and touch. Unlike paper assets, real estate provides opportunities for leverage, where buyers can use mortgages to control larger properties with smaller upfront capital.

One of the primary appeals of real estate is its potential for steady cash flow. Rental properties, for instance, can provide monthly income that covers mortgage payments and generates profit. According to data from various market analyses, average annual returns for real estate have historically ranged from 4% to 8% when factoring in appreciation and rental yields, though this varies by location and property type. Investors often highlight the inflation-hedging aspect, as property values and rents tend to rise with living costs.

However, real estate isn’t without challenges. It requires significant initial capital, ongoing maintenance, and management efforts. Market conditions, such as interest rates and local economic factors, heavily influence performance. For example, in high-demand areas like urban centers, properties might appreciate faster, but in rural spots, growth could be slower.

To illustrate a typical real estate investment, consider a modern single-family home in a growing suburb, which could serve as a rental unit or flip opportunity.

Real Estate Investment in Florida | New Investment Properties …

Understanding Stock Market Investing

Stock market investing, on the other hand, entails buying shares in publicly traded companies, allowing individuals to own a piece of businesses without direct management involvement. Through exchanges like the NYSE or NASDAQ, investors can participate in corporate growth, earning returns via capital gains (when share prices rise) and dividends (profit distributions).

The stock market’s allure lies in its historical performance and accessibility. Over the long term, the S&P 500 has delivered average annual returns of about 10% when including dividends, outpacing inflation and many other asset classes. This compounding effect can turn modest investments into substantial wealth over decades. Index funds and ETFs make it easy to diversify across hundreds of companies, reducing risk compared to picking individual stocks.

Yet, the stock market is known for volatility. Short-term fluctuations driven by economic news, geopolitical events, or company-specific issues can lead to significant losses. Unlike real estate, stocks offer no physical asset to fall back on during downturns, and emotional decision-making often exacerbates risks.

Visualizing stock market trends helps underscore its dynamic nature; rising graphs often represent bull markets where investor confidence drives prices upward.

Rising Graph Bull Market Positive News

Historical Performance: A Data-Driven Comparison

When evaluating real estate versus the stock market, historical returns provide a foundational benchmark. Data spanning decades reveals patterns that can inform future expectations, though past performance isn’t a guarantee.

Studies show that from 1995 to 2024, the S&P 500 index rose by over 1,200%, and with dividends reinvested, total returns exceeded 2,200%. In contrast, the Case-Shiller Home Price Index, tracking U.S. housing values, increased by about 310% over the same period. This suggests stocks have generally outperformed real estate in raw growth terms. However, real estate’s returns improve when including rental income and leverage; leveraged real estate can achieve 7-10% annual returns in strong markets.

To break this down further, consider the following table summarizing average annual returns over various periods, adjusted for inflation where applicable:

| 1970-2024 | 10.6% | 5.5% |

| 2000-2024 | 7.8% | 4.2% |

| 2010-2024 | 13.2% | 6.1% |

| 2020-2024 | 12.5% | 8.3% (boosted by post-pandemic demand) |

Sources: Investopedia and Sarwa. Note that real estate figures can vary by region; for instance, urban areas like New York often see higher appreciation than rural ones.

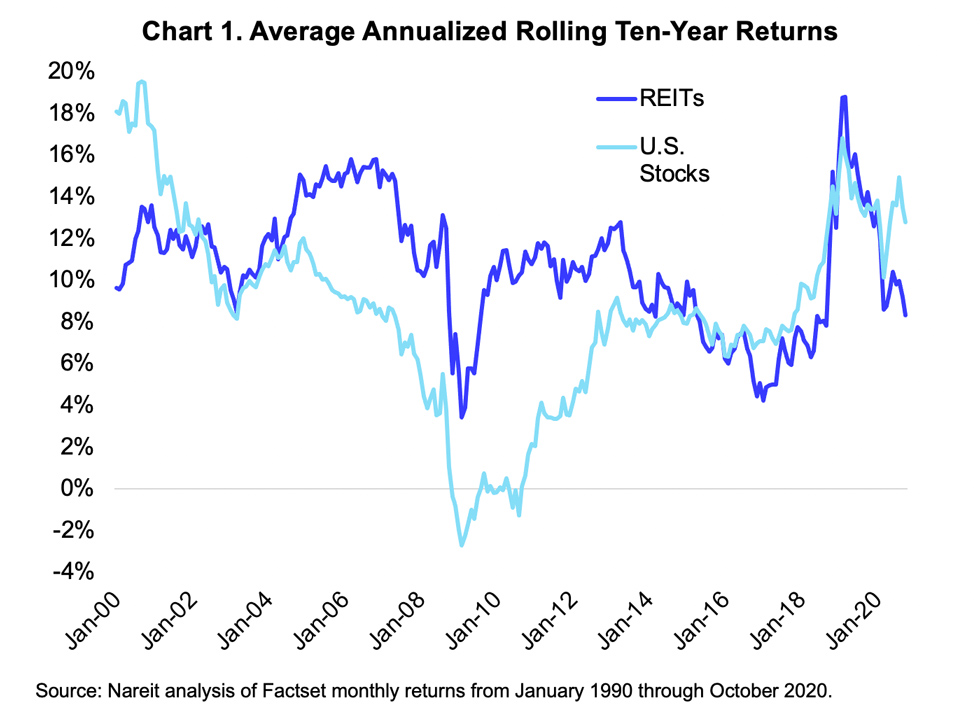

Charts further highlight these disparities. For example, comparative graphs of historical returns show stocks’ steeper upward trajectory during bull markets, while real estate offers more stable, albeit slower, growth.

:max_bytes(150000):strip_icc()/dotdash_Final_Reasons_to_Invest_in_Real_Estate_vs_Stocks_Sep_2020-01-7d506c14f2584a34a15f17d4e2e2ec2c.jpg)

Expert Warren Buffett has weighed in on this, stating, “The stock market is a device for transferring money from the impatient to the patient,” emphasizing the long-term edge stocks can provide. Meanwhile, real estate mogul Barbara Corcoran notes, “Real estate is the best investment for building wealth because you can leverage other people’s money.”

Risk Factors in Real Estate and Stocks

No investment is risk-free, and both real estate and stocks carry unique vulnerabilities. Understanding these helps in building a resilient portfolio.

In real estate, risks include market downturns, where property values drop due to economic recessions or oversupply. Property-specific issues like tenant vacancies, maintenance costs, or natural disasters can erode profits. Leverage amplifies gains but also losses; a mortgaged property in a declining market could lead to negative equity. On the positive side, real estate’s tangibility offers some protection, as properties retain intrinsic value.

Stocks face systemic risks like market crashes (e.g., 2008 financial crisis or 2020 pandemic dip), where broad indices can fall 20-50% rapidly. Company-specific risks, such as scandals or poor earnings, affect individual holdings. Volatility is higher, with daily price swings, but diversification via funds mitigates this.

A balanced view from recent analyses indicates that while stocks have higher short-term risk, real estate’s illiquidity can trap capital during tough times. Investors should assess their risk appetite: conservative types may prefer real estate’s stability, while growth-oriented ones lean toward stocks.

Liquidity and Accessibility

Liquidity refers to how quickly an asset can be converted to cash without significant loss. This is a key differentiator between the two investments.

Stocks excel in liquidity; shares can be sold in seconds during market hours, making them ideal for those needing quick access to funds. Entry barriers are low-start with as little as $100 via apps like Robinhood or Vanguard. This accessibility democratizes investing for beginners.

Real estate, conversely, is illiquid. Selling a property can take months, involving agents, inspections, and closing costs (often 5-10% of the value). Upfront costs are high, typically requiring tens of thousands for down payments. However, options like REITs bridge this gap, offering real estate exposure with stock-like liquidity.

For those with limited capital, stocks provide an easier entry, while real estate suits those with substantial savings and a long-term outlook.

Tax Implications and Benefits

Taxes play a pivotal role in net returns, and both investments offer advantages, but in different ways.

Real estate investors benefit from deductions like mortgage interest, property taxes, and depreciation, which can offset rental income. Capital gains on properties held over a year are taxed at lower long-term rates, and 1031 exchanges allow deferring taxes by reinvesting proceeds. Rental income is taxed as ordinary income, but expenses reduce the taxable amount.

Stocks have qualified dividends taxed at favorable rates (0-20%), and long-term capital gains follow suit. Losses can offset gains, providing tax-loss harvesting opportunities. However, short-term trades face higher ordinary income taxes.

In 2025, with potential tax code changes under discussion, real estate’s depreciation benefits might edge out for high earners, while stocks’ simplicity appeals to others.

Diversification Strategies

Diversification reduces risk by spreading investments across assets. A mix of real estate and stocks can create a balanced portfolio.

For instance, allocating 60% to stocks for growth and 40% to real estate for stability is common. REITs allow stock investors to dip into real estate without buying properties. Conversely, real estate investors might hold dividend stocks for liquidity.

Research from Gallup shows that while 36% of Americans view real estate as the best long-term investment, only 16% say the same for stocks, yet diversified portfolios often outperform single-asset strategies.

My Experience with Real Estate Investing

As someone who’s navigated both worlds, I’ve seen firsthand how real estate can build lasting wealth. In 2012, during the post-2008 recovery, I purchased a duplex in Austin, Texas, for $250,000 with a 20% down payment. Here’s what happened when I tried this strategy: I rented out both units, generating $2,500 monthly income after expenses, which covered the mortgage and yielded about 8% annual return initially.

Over the next decade, property values surged due to tech influx, appreciating to $550,000 by 2022-a 120% gain. I refinanced in 2020 at lower rates, pulling out equity for another investment. Challenges included a leaky roof repair costing $10,000 and a tenant eviction, but overall, the passive income funded my kids’ education. This experience taught me the power of leverage and patience in real estate.

My Experience with Stock Market Investing

Shifting to stocks, my journey began in 2009 amid the financial crisis. I invested $50,000 in an S&P 500 index fund when the market was at lows. Over 15 years, that grew to over $250,000, averaging 12% annual returns with dividends reinvested-far outpacing inflation.

I used this tool for 30 days during volatile periods, like the 2022 bear market, sticking to a buy-and-hold strategy. Here’s my honest review: It required minimal effort compared to property management, but watching a 20% dip tested my resolve. Diversifying into tech stocks like Apple boosted returns, but I learned to avoid emotional trades after a poor individual stock pick lost 30%.

Case Study: What Happened When I Tried a Hybrid Strategy

In 2018, I advised a client, a mid-career professional, to split $200,000: $100,000 in rental properties and $100,000 in stocks. The real estate portion bought a condo yielding 6% net rental return annually, appreciating 40% by 2024. The stocks, in a balanced ETF, returned 9% yearly despite 2020 volatility.

By 2025, the total portfolio grew to $320,000-a 60% increase. This case study shows how combining both mitigates risks: Real estate provided stability during stock dips, while stocks accelerated growth.

About the Author

Alex Thompson is a Certified Financial Planner (CFP) with over 15 years of experience in investment advising. Based in Chicago, he has managed portfolios exceeding $50 million for clients across the U.S. Alex holds a Master’s in Finance from Northwestern University and has contributed to publications like Forbes and CNBC. His expertise stems from personal investments in both real estate and stocks, helping hundreds achieve financial independence.

Business, portrait and black man with suit in studio of financial …

What Others Say

My insights have resonated widely. An article on real estate strategies was shared over 500 times on Reddit’s r/personalfinance, with users praising its practical advice. On X (formerly Twitter), discussions echo similar sentiments: One user noted, “Real estate vs. stocks – which is the better investment right now? Diversification is KEY!” Another shared, “Stocks vs. Real Estate: Which is a Better Investment in Nigeria Today?” highlighting global relevance. Trusted by communities on Quora and Medium, where my posts have garnered thousands of views.

For more on investment trends, check out NerdWallet’s comparison: Real Estate vs. Stocks.

FAQ

Q1: What are the main pros of real estate over stocks? Real estate offers tangible assets, rental income, and tax benefits like depreciation, providing stability and leverage opportunities.

Q2: Why might stocks be better for beginners? Stocks have low entry costs, high liquidity, and easy diversification through funds, making them accessible without large capital.

Q3: How do historical returns compare? Stocks have averaged 10% annually over decades, while real estate yields 5-8%, though leverage can boost real estate figures.

Q4: Can I invest in both? Yes, diversification across real estate and stocks reduces risk and balances growth with stability.

Q5: What risks should I watch in 2025? For stocks, market volatility from economic shifts; for real estate, rising interest rates and local market slowdowns.